reverse sales tax calculator quebec

Use our calculator to determine your tax or Reverse Quebecs cur. QST Tax Rate.

![]()

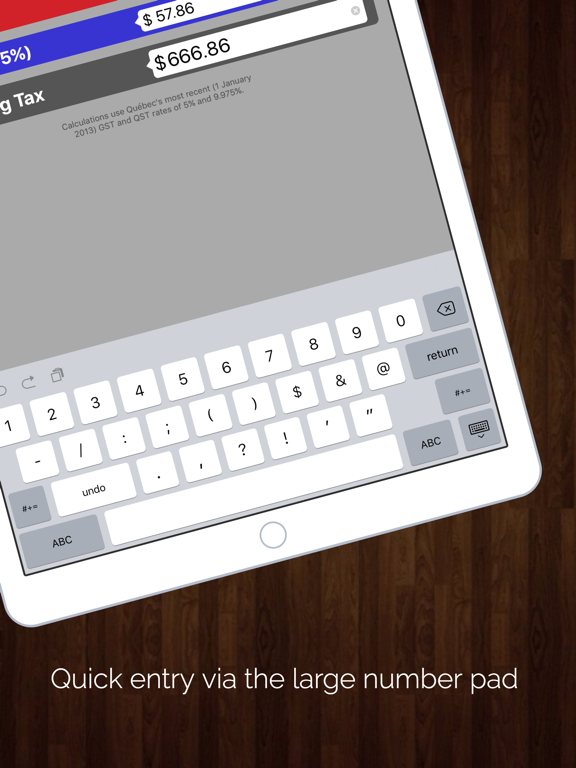

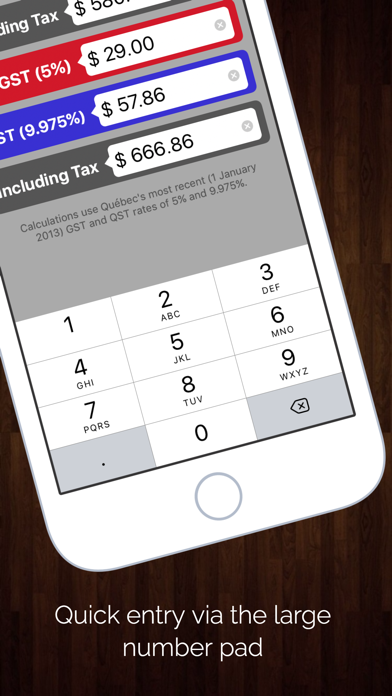

Quebec Sales Tax Calculator On The App Store

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

. You just set the province to Quebec set the dollar amount you want to reverse and the tool will do the rest. Welcome to Calcul Taxes. Calculator to calculate sales taxes in Quebec.

Here is how the total is calculated before sales tax. This app is so easy to use youll never want to bother again using a calculator app to determine how much taxes youre going to pay on something. In Quebec merchants have to pay GST and QST for all the sales madeCalculate you sales tax.

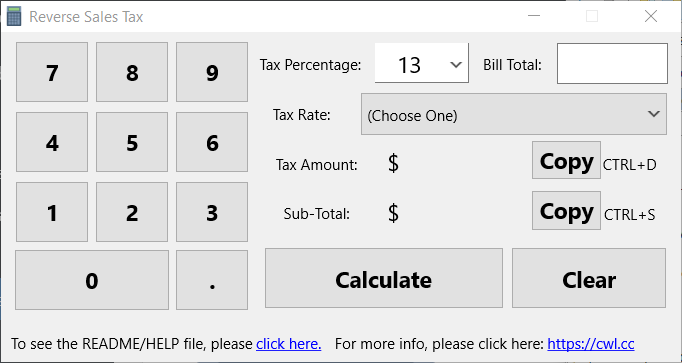

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. The TIP is at least equal to the sum of the taxes TPS TVQ is 15. Instead of using the reverse sales tax calculator you can compute this manually.

Price before Tax Total Price with Tax - Sales Tax. Reverse Sales tax calculator British-Columbia BC GSTPST 2017. In Quebec the provincial sales tax is known as Quebec sales tax.

Reverse tax calculator quebec. Sales tax amount or rate. You can also calculate the price before tax if you only have the after tax amount.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. To calculate the sales tax amount for all other values use our sales tax calculator above. Enter the final price or amount.

No sales tax have to be applied Reverse calculator of the GST and QST. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Reverse Sales Tax Rates Calculator Canadian Provinces and Territories An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces.

It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975.

Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. Below is a table of common values that can be used as a quick lookup tool for a sales tax rate of 14975 in Quebec Canada. Its great to have a reverse GST QST calculator because it will save you a lot of time when youre trying to figure out how much taxes you have.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. You can use this method to find the original price of an item after a. All numbers are rounded in the normal fashion.

You will need to input the following. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Sales tax calculator GST QST.

Canada Sales Tax Chart Date Difference Calculator. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. Calculate Quebec residents sales taxes outside Canada.

- Tous droits réservés Ontario. Current HST GST and PST rates table of 2022. To find the original price of an item you need this formula.

Sales tax calculator GST QST 2016. However you can give more or less depending on the quality of service received. The above calculator works as a reverse GST QST calculator also.

This app is easy to use and fast. Amount with sales tax 1 GST and QST. Calculate the sales tax in Quebec GST and QST in no time.

Price before Tax Total Price with Tax 1 Sales Tax Rate. See the article. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

Online calculator calculates Reverse Québec sales taxes - GST and QST 2020. This is the after-tax amount. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

Sales Tax Rate Sales Tax Percent 100. Calculators Canada sales tax. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

Tax rate for all canadian remain the same as in 2017. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. The only thing to remember in our Reverse Sales.

Canada Sales Tax Calculator By Tardent Apps Inc

Pst Calculator Calculatorscanada Ca

Calcul Taxes Quebec Tps Tvq By Joseph Pellerin

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Quebec Tax Calculator Gst Qst Apps On Google Play

Sales Tax Canada Calculator On The App Store

Quebec Sales Tax Calculator On The App Store

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Quebec Tax Calculator Gst Qst Apps On Google Play

How To Calculate The Taxes Gst Pst And The Final Price Youtube

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator On The App Store

How To Calculate Sales Tax In Excel Tutorial Youtube

Quebec Sales Tax Calculator Apps On Google Play

Reverse Hst Calculator Hstcalculator Ca

Updated Canada Sales Tax Calculator Gst Hst Pst Qst For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Updated Canada Sales Tax Calculator Gst Hst Pst Qst For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022